Press Release

Fiscal Second Quarter 2017 Financial Highlights

-

Record total revenue of

$24.1 million , up 17% year over year -

Cash Flow Positive from Operations; Cash Balance

$15.7 million -

Transportation Systems revenue of

$12.3 million , up 46% year over year -

Agriculture and Weather Analytics (formerly known as Performance

Analytics) revenue of

$800,000 , up 51% year over year -

Improved earnings performance; GAAP net loss in the second quarter was

$40,000 , or($0.00) per share, compared to a GAAP net loss of$395,000 , or($0.01) per share, in second quarter a year ago

Management commentary:

“We are pleased to deliver another quarter of record revenue results and

significant improvement in operating income,” said

“We continue to see powerful, global trends in both our transportation

and agriculture end-markets, and expect these trends to benefit

Business Segment Reassignment

Beginning in the Company’s first fiscal quarter of 2017, certain operations that were previously within its Agriculture and Weather Analytics segment (formerly known as Performance Analytics), specifically its performance measurement and information management solution iPeMS® and related traffic consulting services, were reassigned to the Transportation Systems segment to better align the Company’s traffic analytics capabilities, resources and initiatives. Prior year segment information presented in the table below has been re-classified to reflect this change.

GAAP Fiscal Second Quarter 2017 Financial Results

Total revenues in the second quarter of fiscal 2017 increased 17% to a

record

Operating expenses in the second quarter were

Operating loss in the second quarter was

Non-GAAP Fiscal Q2 2017 Financial Results

In addition to results presented in accordance with generally accepted

accounting principles in

Non-GAAP operating expenses in the second quarter increased to

Earnings Conference Call

Date:

Time:

Toll-free dial-in number:

1-888-208-1814

International dial-in number: 1-719-325-2460

Conference

ID: 7099785

To listen to the live or archived webcast of the earnings call or to

view the press release, please visit the investor

relations section of the

A replay of the conference call will be available after

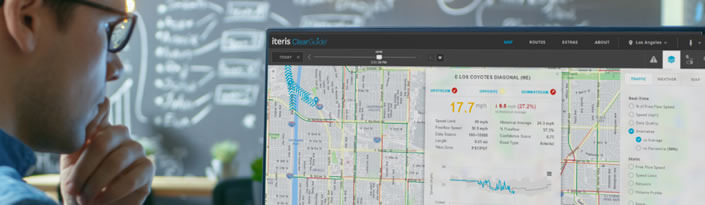

About

Iteris is the global leader in applied informatics for transportation and agriculture, turning big data into big breakthrough solutions. We collect, aggregate and analyze data on traffic, roads, weather, water, soil and crops to generate precise informatics that lead to safer transportation and smarter farming. Municipalities, government agencies, crop science companies, farmers and agronomists around the world use our solutions to make roads safer and travel more efficient, as well as farmlands more sustainable, healthy and productive. Visit www.iteris.com for more information.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

This release may contain forward-looking statements, which speak only as of the date hereof and are based upon our current expectations and the information available to us at this time. Words such as "believes," "anticipates," "expects," "intends," "plans," "seeks," "estimates," "may," "will," "can," and variations of these words or similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements about the Company’s anticipated growth opportunities, the impact of the new management team, the impact and success of new product introductions and acquisitions, our future performance, growth, operating results, financial condition and prospects. Such statements are subject to certain risks, uncertainties, and assumptions that are difficult to predict and actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors.

Important factors that may cause such a difference include, but are not

limited to, federal, state and local government budgetary issues,

constraints and delays; the timing and amount of government funds

allocated to overall transportation infrastructure projects and the

transportation industry; the potential impact of the recently extended

Federal Highway Bill on the Intelligent Transportation industry and the

expected benefits to

| ITERIS, INC. | |||||||

| UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS | |||||||

| (in thousands) | |||||||

| September 30, | March 31, | ||||||

| 2016 | 2016 | ||||||

| ASSETS: | |||||||

| Cash | $ | 15,713 | $ | 16,029 | |||

| Trade accounts receivable, net | 12,459 | 13,241 | |||||

| Costs and estimated earnings in excess of billings | |||||||

| on uncompleted contracts | 6,983 | 5,250 | |||||

| Inventories | 2,774 | 3,153 | |||||

| Prepaid expenses and other current assets | 2,022 | 1,505 | |||||

| Total current assets | 39,951 | 39,178 | |||||

| Property and equipment, net | 2,168 | 2,139 | |||||

| Goodwill | 17,318 | 17,318 | |||||

| Intangible and other assets, net | 1,385 | 1,385 | |||||

| Total assets | $ | 60,822 | $ | 60,020 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | |||||||

| Accounts payable and other current liabilities | $ | 12,777 | $ | 12,633 | |||

| Billings in excess of costs and estimated earnings | |||||||

| on uncompleted contracts | 2,403 | 2,294 | |||||

| Total current liabilities | 15,180 | 14,927 | |||||

| Long-term liabilities | 1,593 | 1,631 | |||||

| Total liabilities | 16,773 | 16,558 | |||||

| Stockholders’ equity | 44,049 | 43,462 | |||||

| Total liabilities and stockholders’ equity | $ | 60,822 | $ | 60,020 | |||

| ITERIS, INC. | ||||||||||||

| UNAUDITED CONSOLIDATED | ||||||||||||

| STATEMENTS OF OPERATIONS | ||||||||||||

| (in thousands, except per share amounts) | ||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||

| September 30, | September 30, | |||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||

| Total revenues | $ | 24,060 | $ | 20,573 | $ | 47,986 | $ | 38,938 | ||||

| Cost of revenues | 14,605 | 12,690 | 29,122 | 23,417 | ||||||||

| Gross profit | 9,455 | 7,883 | 18,864 | 15,521 | ||||||||

| Operating expenses: | ||||||||||||

| Selling, general and administrative | 7,858 | 6,286 | 15,663 | 12,774 | ||||||||

| Research and development | 1,698 | 2,074 | 3,308 | 3,577 | ||||||||

| 84 | 92 | 169 | 184 | |||||||||

| Amortization of intangible assets | ||||||||||||

| Total operating expenses | 9,640 | 8,452 | 19,140 | 16,535 | ||||||||

| Operating loss | (185) | (569) | (276) | (1,014) | ||||||||

| Non-operating income (expense): | ||||||||||||

| Other (expense) income, net | (2) | 4 | (6) | 4 | ||||||||

| Interest income, net | 4 | 4 | 5 | 7 | ||||||||

| Loss from continuing operations before income taxes | (183) | (561) | (277) | (1,003) | ||||||||

| Benefit for income taxes | 8 | 112 | 7 | 310 | ||||||||

| Loss from continuing operations | (175) | (449) | (270) | (693) | ||||||||

| Gain on sale of discontinued operation, net of tax | 135 | 54 | 191 | 106 | ||||||||

| Net loss | $ | (40) | $ | (395) | $ | (79) | $ | (587) | ||||

| Loss per share from continuing operations – | (0.01) | (0.01) | (0.01) | (0.02) | ||||||||

|

basic and diluted |

$ | $ | $ | $ | ||||||||

| Gain per share from sale of discontinued operation – | 0.01 | 0.00 | 0.01 | 0.00 | ||||||||

| basic and diluted | $ | $ | $ | $ | ||||||||

| Net loss per share - basic and diluted | $ | (0.00) | $ | (0.01) | $ | (0.00) | $ | (0.02) | ||||

| Shares used in basic and diluted per share calculations | 32,117 | 31,935 | 32,085 | 32,069 | ||||||||

| ITERIS, INC. | |||||||||||||

| UNAUDITED SEGMENT REPORTING DETAILS | |||||||||||||

| (in thousands) | |||||||||||||

| Roadway Sensors | Transportation Systems | Ag & Weather Analytics | Iteris, Inc. | ||||||||||

| Three Months Ended September 30, 2016 | |||||||||||||

| Total revenues | $ | 10,895 | $ | 12,327 | $ | 838 | $ | 24,060 | |||||

| Segment operating income (loss) | $ | 2,647 | $ | 2,549 | $ | (2,077) | $ | 3,119 | |||||

| Corporate and other income (expense), net | (3,220) | ||||||||||||

| Amortization of intangible assets | (84) | ||||||||||||

| Operating loss | $ | (185) | |||||||||||

| Roadway Sensors | Transportation Systems | Ag & Weather Analytics | Iteris, Inc. | ||||||||||

| Three Months Ended September 30, 2015 | |||||||||||||

| Total revenues | $ | 11,559 | $ | 8,459 | $ | 555 | $ | 20,573 | |||||

| Segment operating income (loss) | $ | 2,457 | $ | 1,195 | $ | (2,050) | $ | 1,602 | |||||

| Corporate and other income (expense), net | (2,079) | ||||||||||||

| Amortization of intangible assets | (92) | ||||||||||||

| Operating loss | $ | (569) | |||||||||||

| Roadway Sensors | Transportation Systems | Ag & Weather Analytics | Iteris, Inc. | ||||||||||

| Six Months Ended September 30, 2016 | |||||||||||||

| Total revenues | $ | 21,499 | $ | 24,726 | $ | 1,761 | $ | 47,986 | |||||

| Segment operating income (loss) | $ | 4,956 | $ | 4,894 | $ | (3,690) | $ | 6,160 | |||||

| Corporate and other income (expense), net | (6,267) | ||||||||||||

| Amortization of intangible assets | (169) | ||||||||||||

| Operating loss | $ | (276) | |||||||||||

| Roadway Sensors | Transportation Systems | Ag & Weather Analytics | Iteris, Inc. | ||||||||||

| Six Months Ended September 30, 2015 | |||||||||||||

| Total revenues | $ | 21,464 | $ | 16,252 | $ | 1,222 | $ | 38,938 | |||||

| Segment operating income (loss) | $ | 5,197 | $ | 2,046 | $ | (3,358) | $ | 3,885 | |||||

| Corporate and other income (expense), net | (4,715) | ||||||||||||

| Amortization of intangible assets | (184) | ||||||||||||

| Operating loss | $ | (1,014) | |||||||||||

Non-GAAP Financial Measures and

Reconciliation

In addition to results presented in accordance with GAAP, the Company has included the following non-GAAP financial measures in this release: non-GAAP operating expenses, non-GAAP operating (loss) income, non-GAAP net income and non-GAAP basic and diluted earnings per share from continuing operations. These non-GAAP financial measures exclude the following items: (a) audit fee overruns; (b) financial consulting services; (c) severance and transition related costs paid to the Company’s former Chief Executive Officer; and (d) the estimated income tax effect of the foregoing non-GAAP adjustments.

Management uses certain non-GAAP financial measures internally for strategic decision making, forecasting future results and evaluating current performance. Non-GAAP financial measures are not prepared in accordance with GAAP; therefore, the information is not necessarily comparable to other companies' financial information and should be considered as a supplement to, not a substitute for, or superior to, the corresponding financial measures calculated in accordance with GAAP.

Details of the items excluded from GAAP financial results in calculating non-GAAP financial measures and explanatory footnotes are as follows:

| a) | Audit fee overruns were calculated as the amount of audit fees that exceeded the expected fees per the Company’s audit engagement letters. For the audit of Fiscal 2015, approximately $150,000 of fee overruns were recorded into the first fiscal quarter of 2016 and no audit fees were incurred in second fiscal quarter of 2016. | |||||

| b) | Management engaged financial consulting service firms to assist with the completion of its Fiscal 2015 and Fiscal 2014 audits. The fees incurred for assistance with the Fiscal 2015 audit were incurred during the first quarter of Fiscal 2016. | |||||

| c) | On February 25, 2015, the Company’s Chief Executive Officer resigned and, as a result, the Company incurred approximately $86,000 and $63,000 in severance and transition related expenses in the first and second fiscal quarters of 2016, respectively. | |||||

| d) | The amount represents the estimated income tax effect of the non-GAAP adjustments. The tax effect of non-GAAP adjustments was calculated by applying an estimated tax rate of 38% to each specific non-GAAP item. | |||||

| Iteris, Inc. | ||||||||||||

| Schedule Reconciling GAAP Net (Loss) to Non-GAAP Net (Loss) | ||||||||||||

| ($ in thousands, except per share amounts) | ||||||||||||

| (unaudited) | ||||||||||||

| For the Three Months Ended | For the Nine Months Ended | |||||||||||

| September 30, | September 30, | |||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||

| GAAP net loss | $ | (40) | $ | (395) | $ | (79) | $ | (587) | ||||

| GAAP loss per share from continuing operations - | ||||||||||||

| basic and diluted | $ | (0.01) | $ | (0.01) | $ | (0.01) | $ | (0.02) | ||||

| The non-GAAP amounts have been adjusted to | ||||||||||||

| exclude the following items: | ||||||||||||

| Excluded from operating expenses | ||||||||||||

| Audit Fee overrun (a) | $ | - | $ | - | $ | - | $ | (150) | ||||

| Financial consulting services (b) | - | - | - | (161) | ||||||||

| Executive management severance costs (c) | - | (63) | - | (149) | ||||||||

| Total excluded from operating expenses | $ | - | $ | (63) | $ | - | $ | (460) | ||||

| Total excluded operating loss | $ | - | $ | (63) | $ | - | $ | (460) | ||||

| Income tax effect on non-GAAP adjustments (d) | - | 24 | - | 175 | ||||||||

| Total excluded from operating expenses after | ||||||||||||

| income tax effect | $ | - | $ | (39) | $ | - | $ | (285) | ||||

| Non-GAAP net loss | $ | (40) | $ | (356) | $ | (79) | $ | (302) | ||||

| Non-GAAP loss per share from continuing | ||||||||||||

| operations - basic and diluted | $ | (0.00) | $ | (0.01) | $ | (0.00) | $ | (0.01) | ||||

| (a) - (d) See corresponding footnotes above. | ||||||||||||

| Iteris, Inc. | ||||||||||||

| Schedule Reconciling GAAP Operating (Loss) to Non-GAAP Operating (Loss) Income | ||||||||||||

| ($ in thousands, except per share amounts) | ||||||||||||

| (unaudited) | ||||||||||||

| For the Three Months Ended | For the Nine Months Ended | |||||||||||

| September 30, | September 30, | |||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||

| GAAP operating expenses | $ | 9,640 | $ | 8,452 | $ | 19,140 | $ | 16,535 | ||||

| Audit Fee overrun (a) | - | - | - | (150) | ||||||||

| Financial consulting services (b) | - | - | - | (161) | ||||||||

| Executive management severance costs (c) | - | (63) | - | (149) | ||||||||

| Non-GAAP operating expenses | $ | 9,640 | $ | 8,389 | $ | 19,140 | $ | 16,075 | ||||

| GAAP operating loss | $ | (185) | $ | (569) | $ | (276) | $ | (1,014) | ||||

| Audit Fee overrun (a) | - | - | - | (150) | ||||||||

| Financial consulting services (b) | - | - | - | (161) | ||||||||

| Executive management severance costs (c) | - | (63) | - | (149) | ||||||||

| Non-GAAP operating loss | $ | (185) | $ | (506) | $ | (276) | $ | (554) | ||||

View source version on businesswire.com: http://www.businesswire.com/news/home/20161109005979/en/

Source:

Investor Relations

MKR Group, Inc.

Todd Kehrli

323-468-2300

iti@mkr-group.com