Press Release

- Revenues Up to

Expanded

Patent and Product Portfolios -

Fiscal Q1 2016 Highlights

-

Roadway Sensors revenues up 10% YOY to

$9.9 million - Total gross margin improved 400 basis points YOY to 41.6

-

Total backlog increased 17% YOY to

$45.3 million - Precision Agriculture deal pipeline building

- Eight new patent awards for our core Agriculture technology

-

Repurchased approximately 402,000 shares of common stock for

$735,000

Management Commentary

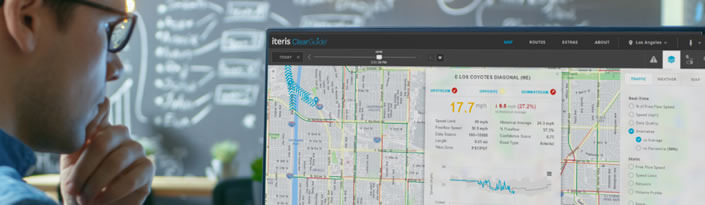

“We are very pleased with the results of Q1 of our fiscal year 2016. We

saw continued strength in our Transportation sector businesses with

increases in both revenue and gross margin. Once again, this growth was

driven by a 10% increase in our Sensors business,” said

“We are also very encouraged to see substantial strategic formation in

the Transportation sector. The transportation market is being energized

by new initiatives such as Connected Vehicles. We showcased a number of

key

GAAP Fiscal Q1 2016 Financial Results

Total revenues in the first quarter of 2016 increased to

Gross margin in the first quarter increased 400 basis points to 41.6% compared to 37.6% in the same quarter a year ago. The increase in gross margin was primarily attributable to improved gross margins within the Roadway Sensors segment, as well as an overall increase in Roadway Sensors sales as a percentage of total company sales to approximately 54%, compared to approximately 50% in the same quarter a year ago. The increase in gross margins was also attributable, to a lesser extent, by improved Transportation Systems gross margins.

Operating expenses in the first quarter increased to

Operating loss in the first quarter was

Total backlog at the end of the first quarter increased 17% to

Non-GAAP Fiscal Q1 2016 Financial Results

In addition to results presented in accordance with generally accepted

accounting principles in

Total revenues in the first quarter of 2016 increased to

Gross margin in the first quarter increased 400 basis points to 41.6% compared to 37.6% in the same quarter a year ago. The increase in gross margin was primarily attributable to improved gross margins within the Roadway Sensors segment, as well as an overall increase in Roadway Sensors sales as a percentage of total company sales to approximately 54%, compared to approximately 50% in the same quarter a year ago. The increase in gross margins was also attributable, to a lesser extent, by improved Transportation Systems gross margins.

Non-GAAP operating expenses in the first quarter increased to

Non-GAAP operating loss in the first quarter was

Conference Call

Iteris’ interim CEO

Date:

Time:

Toll-free dial-in number: 1-888-539-3612

International

dial-in number: 1-719-325-2393

Conference ID: 2707158

To listen to the live webcast or view the press release, please visit

the investor

relations section of the

A replay of the conference call will be available after

Toll-free replay number: 1-877-870-5176

International replay

number: 1-858-384-5517

Replay ID: 2707158

About

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

This release may contain forward-looking statements, which speak only as of the date hereof and are based upon our current expectations and the information available to us at this time. Words such as "believes," "anticipates," "expects," "intends," "plans," "seeks," "estimates," "may," "will," "can," and variations of these words or similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements about the Company’s anticipated growth opportunities, the impact and success of new product introductions and acquisitions, our future performance, growth, operating results, financial condition and prospects. Such statements are subject to certain risks, uncertainties, and assumptions that are difficult to predict and actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors.

Important factors that may cause such a difference include, but are not

limited to, federal, state and local government budgetary issues,

constraints and delays; the timing and amount of government funds

allocated to overall transportation infrastructure projects and the

transportation industry; the potential impact of the recently extended

Federal Highway Bill on the Intelligent Transportation industry and the

expected benefits to

| ITERIS, INC. | ||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||

|

(in thousands) |

||||||

| June 30, | March 31, | |||||

| 2015 | 2015 | |||||

| (unaudited) | ||||||

| ASSETS: | ||||||

| Cash | $ | 18,896 | $ | 21,961 | ||

| Trade accounts receivable, net | 11,653 | 11,206 | ||||

| Costs and estimated earnings in excess of billings | ||||||

| on uncompleted contracts | 4,195 | 4,266 | ||||

| Inventories | 3,026 | 3,062 | ||||

| Prepaid expenses and other current assets | 1,876 | 1,338 | ||||

| Current portion of deferred income taxes | 2,680 | 2,680 | ||||

| Total current assets | 42,326 | 44,513 | ||||

| Property and equipment, net | 2,162 | 1,990 | ||||

| Long-term portion of deferred income taxes | 5,784 | 5,610 | ||||

| Goodwill | 17,318 | 17,318 | ||||

| Intangible and other assets, net | 1,052 | 1,201 | ||||

| Total assets | $ | 68,642 | $ | 70,632 | ||

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | ||||||

| Accounts payable and other current liabilities | $ | 10,950 | $ | 12,106 | ||

| Billings in excess of costs and estimated earnings | ||||||

| on uncompleted contracts | 1,573 | 1,549 | ||||

| Total current liabilities | 12,523 | 13,655 | ||||

| Long-term liabilities | 995 | 1,009 | ||||

| Total liabilities | 13,518 | 14,664 | ||||

| Stockholders’ equity | 55,124 | 55,968 | ||||

| Total liabilities and stockholders’ equity | $ | 68,642 | $ | 70,632 | ||

| ITERIS, INC. | ||||||||

| UNAUDITED CONSOLIDATED | ||||||||

| STATEMENTS OF OPERATIONS | ||||||||

| (in thousands, except per share amounts) | ||||||||

| Three Months Ended | ||||||||

| June 30, | ||||||||

| 2015 | 2014 | |||||||

| Total revenues | $ | 18,365 | $ | 18,116 | ||||

| Cost of revenues | 10,728 | 11,309 | ||||||

| Gross profit | 7,637 | 6,807 | ||||||

| Operating expenses: | ||||||||

| Selling, general and administrative | 6,488 | 5,700 | ||||||

| Research and development | 1,503 | 1,079 | ||||||

| Amortization of intangible assets | 92 | 119 | ||||||

| Change in fair value of contingent | - | 4 | ||||||

| acquisition consideration | ||||||||

| Total operating expenses | 8,083 | 6,902 | ||||||

| Operating loss | (446 | ) | (95 | ) | ||||

| Non-operating (expense) income: | ||||||||

| Other (expense), net | - | (3 | ) | |||||

| Interest income, net | 4 | 1 | ||||||

| Loss from continuing operations before income taxes | (442 | ) | (97 | ) | ||||

| Benefit for income taxes | 198 | 29 | ||||||

| Loss from continuing operations | (244 | ) | (68 | ) | ||||

| Gain on sale of discontinued operation, net of tax | 52 | 49 | ||||||

| Net loss | $ | (192 | ) | $ | (19 | ) | ||

| Loss per share from continuing operations – | (0.01 | ) | (0.00 | ) | ||||

| basic and diluted | $ | $ | ||||||

| Gain per share from sale of discontinued operation – | 0.00 | 0.00 | ||||||

| basic and diluted | $ | $ | ||||||

| Net loss per share - basic and diluted | $ | (0.01 | ) | $ | (0.00 | ) | ||

| Shares used in basic per share calculations | 32,203 | 32,657 | ||||||

| Shares used in diluted per share calculations | 32,203 | 32,657 | ||||||

| ITERIS, INC. | ||||||||||||||

| UNAUDITED SEGMENT REPORTING DETAILS | ||||||||||||||

| (in thousands) | ||||||||||||||

| Roadway Sensors | Transportation Systems | Performance Analytics | Iteris, Inc. | |||||||||||

| Three Months Ended June 30, 2015 | ||||||||||||||

| Total revenues | $ | 9,905 | $ | 7,378 | $ | 1,082 | $ | 18,365 | ||||||

| Segment operating income (loss) | $ | 2,602 | $ | 927 | $ | (1,666 | ) | $ | 1,863 | |||||

| Corporate and other income (expense), net | (2,217 | ) | ||||||||||||

| Amortization of intangible assets | (92 | ) | ||||||||||||

| Change in fair value of contingent acquisition consideration | - | |||||||||||||

| Operating loss | $ | (446 | ) | |||||||||||

| Roadway Sensors | Transportation Systems | Performance Analytics | Iteris, Inc. | |||||||||||

| Three Months Ended June 30, 2014 | ||||||||||||||

| Total revenues | $ | 9,020 | $ | 7,665 | $ | 1,431 | $ | 18,116 | ||||||

| Segment operating income (loss) | $ | 1,797 | $ | 854 | $ | (694 | ) | $ | 1,957 | |||||

| Corporate and other income (expense), net | (1,929 | ) | ||||||||||||

| Amortization of intangible assets | (119 | ) | ||||||||||||

| Change in fair value of contingent acquisition consideration | (4 | ) | ||||||||||||

| Operating loss | $ | (95 | ) | |||||||||||

Non-GAAP Financial Measures and

Reconciliation

In addition to results presented in accordance with GAAP, the Company has included the following non-GAAP financial measures in this release: non-GAAP operating expenses, non-GAAP operating (loss) income, non-GAAP net income and non-GAAP basic and diluted earnings per share from continuing operations. These non-GAAP financial measures exclude the following items: (a) audit fee overruns; (b) financial consulting services; (c) severance payable to the Company’s former Chief Executive Officer; and (d) the estimated income tax effect of the foregoing non-GAAP adjustments.

Management uses certain non-GAAP financial measures internally for strategic decision making, forecasting future results and evaluating current performance. Non-GAAP financial measures are not prepared in accordance with GAAP; therefore, the information is not necessarily comparable to other companies' financial information and should be considered as a supplement to, not a substitute for, or superior to, the corresponding financial measures calculated in accordance with GAAP.

Details of the items excluded from GAAP financial results in calculating non-GAAP financial measures and explanatory footnotes are as follows:

a) Audit fee overruns were calculated as the amount of audit fees that

exceeded the expected fees per the Company’s audit engagement letters.

For the audit of Fiscal 2015, approximately

b) Management engaged financial consulting service firms to assist with the completion of its Fiscal 2015 and Fiscal 2014 audits, which were incurred during the first quarters of Fiscal 2016 and Fiscal 2015, respectively.

c) On

d) The amount represents the estimated income tax effect of the non-GAAP adjustments. The tax effect of non-GAAP adjustments was calculated by applying the applicable estimated tax rate of 38% to each specific non-GAAP item.

| Iteris, Inc. | ||||||||||

| Schedule Reconciling GAAP Net (Loss) to Non-GAAP Net Income | ||||||||||

| ($ in thousands, except per share amounts) | ||||||||||

| (unaudited) | ||||||||||

| For the Three Months Ended | ||||||||||

| June 30, | June 30, | |||||||||

| 2015 | 2014 | |||||||||

| GAAP net loss | $ | (192 | ) | $ | (19 | ) | ||||

| GAAP loss per share from continuing operations - basic and diluted | $ | ($0.01 | ) | $ | ($0.00 | ) | ||||

| The non-GAAP amounts have been adjusted to | ||||||||||

| exclude the following items: | ||||||||||

| Excluded from operating expenses | ||||||||||

| Audit Fee overrun (a) | $ | (150 | ) | $ | (345 | ) | ||||

| Financial consulting services (b) | (161 | ) | (31 | ) | ||||||

| Executive management severance costs (c) | (86 | ) | - | |||||||

| Total excluded from operating expenses | $ | (397 | ) | $ | (376 | ) | ||||

| Total excluded operating loss | $ | (397 | ) | $ | (376 | ) | ||||

| Income tax effect on non-GAAP adjustments (d) | 151 | 143 | ||||||||

| Total excluded from operating expenses after taxes | $ | (246 | ) | $ | (233 | ) | ||||

| Non-GAAP net income | $ | 54 | $ | 214 | ||||||

| Non-GAAP income per share from continuing operations - basic and diluted | $ |

|

0.00 | $ | 0.01 | |||||

| (a) - (d) See corresponding footnotes above. | ||||||||||

| Iteris, Inc. | |||||||||

| Schedule Reconciling GAAP Operating (Loss) to Non-GAAP Operating (Loss) Income | |||||||||

| ($ in thousands, except per share amounts) | |||||||||

| (unaudited) | |||||||||

| For the Three Months Ended | |||||||||

| June 30, | June 30, | ||||||||

| 2015 | 2014 | ||||||||

| GAAP operating expenses | $ | 8,083 | $ | 6,902 | |||||

| Audit Fee overrun (a) | (150 | ) | (345 | ) | |||||

| Financial consulting services (b) | (161 | ) | (31 | ) | |||||

| Executive management severance costs (c) | (86 | ) | - | ||||||

| Non-GAAP operating expenses | $ | 7,686 | $ | 6,526 | |||||

| GAAP operating loss | $ | (446 | ) | $ | (95 | ) | |||

| Audit Fee overrun (a) | (150 | ) | (345 | ) | |||||

| Financial consulting services (b) | (161 | ) | (31 | ) | |||||

| Executive management severance costs (c) | (86 | ) | - | ||||||

| Non-GAAP operating (loss) income | $ | (49 | ) | $ | 281 | ||||

View source version on businesswire.com: http://www.businesswire.com/news/home/20150812006121/en/

Source:

Liolios Group, Inc.

Scott Liolios or Cody Slach

Investor

Relations

Tel 1-949-574-3860

ITI@liolios.com